The Information Deluge

If there’s a development to be noticed throughout all industries and walks of life, it’s that information is consuming—or extra precisely flooding—the world. Final yr it was estimated that by 2020 the quantity of knowledge within the digital realm would attain 44 zettabytes. That’s forty instances extra bytes than there are stars within the observable universe. Fairly a sobering statistic, you’ll agree. Now, what proportion of that information may be accounted for by cat movies alone, we’re not fully certain.

An analogous development is observable within the business that we’ve been following most carefully at Devexperts; that of on-line buying and selling. The place the price of procuring, managing and storing market information was as soon as so negligible that it hardly factored into the enterprise methods of most brokerages, at present there’s a whole cottage business rising up round serving to brokers to optimise this most significant side of their companies.

The web FX business has gone by way of plenty of notable shifts in recent times. You could have observed many established manufacturers attempting to shake off the “FX” a part of their names in favour of “Markets” in recent times. The primary forays they made into increasing past the same old main, minor and unique forex pairs was the addition of treasured metals and power to their respective choices nicely over a decade in the past. This was adopted by shares, indices, futures, bonds and most just lately crypto belongings and ETFs. Every new addition of an asset class brings with it bundles of symbols that should be built-in, transmitted and saved.

This shift to multi-asset brokerage, the concomitant popularisation and development of the business itself, in addition to developments in algorithmic and high-frequency buying and selling, have all multiplied the quantity of information that brokerages should deal with. Extra devices, extra merchants and extra transactions have led to spiraling information prices. That is the place the enterprise of information distributors lies, however the place brokerage companies depends on distributors. For example, dxFeed, our market information subsidiary, presently shops petabytes of market information. By means of the course of our work within the business, we’ve recognized a number of key inefficiencies within the administration of this information and we’d prefer to share a few of our insights at the moment.

Carry out Common Audits

Right this moment’s flood of market information is forcing many to dedicate at the very least some operational bandwidth to market information administration. It could appear counter-intuitive to recommend {that a} dealer wishing to chop prices ought to dedicate further sources to this, however you possibly can’t optimise one thing that’s costing you cash with out taking the time to know why and the way. Notably on the subject of an space as business-critical as market information. Market information administration needs to be a part of each brokerage’s total technique. This entails performing common utilization audits to be able to determine which distributors are important to the enterprise, which have raised their costs and what alternate options there are out there. Is there an overlap between distributors? In that case it’s essential to determine redundancies. Is your online business paying for packages that you just don’t want and aren’t utilizing? Are long run agreements actually saving you cash or locking you down in an ever-changing market the place vendor flexibility may very well be a aggressive benefit?

Optimise What You Have

When you’ve taken inventory of exactly what information you’re receiving from which distributors and made cuts to account for redundancies and pointless streams, its time work on benefiting from the information that you just’re truly paying for. There are lots of brokers who nonetheless stream unrefined market information at further value to their companies. Using compression algorithms to match feeds and filter worth spikes that change inside a given proportion, will nearly definitely add worth to the information that you just’re already paying for. It can additionally enhance the expertise of buying and selling along with your agency as spikes wreak havoc on the perfect laid plans of nearly all of your merchants, needlessly triggering restrict and stop-loss orders with out there having been a basic change in development.

Price of Service

Your biggest financial savings are prone to be made by specializing in the prices of your subscriptions. That is the place competent third events can are available in to supply technological options that may radically reduce prices. Such suppliers are able to supplying information that approximates the unique real-time trade streams. This massively reduces trade prices as the tactic employs derived information that can’t be used to reconstitute authentic tick information.

Moreover, choosing a 3rd occasion supplier will typically enable for rather more management over the image information that you just pay for. The packages of many of the current huge gamers may be rigid, requiring you to buy minimal units of symbols, a few of which will not be of curiosity to your merchants. Superior third events will assist you to make the most of a choose ‘n’ combine strategy, the place you possibly can choose the symbols that you just require and solely pay for these.

Price of Storage

As retail merchants turn into extra subtle of their understanding and evaluation, getting access to correct worth histories turns into all of the extra essential. How far worth histories go is often decided by IT budgets however this needn’t be the case. A reliable third occasion supplier could have choices that may be tailor-made to the wants of your merchants. These embody historic worth information that may be streamed on-demand, in addition to detailed market replay information that’s required by superior shoppers who want to backtest and optimise their buying and selling bots.

Price of Transmission

Retail brokerages are often hamstrung on this regard as the best way they distribute information will not be of their management when utilizing a third-party platform. There are a number of technological hacks may be employed to optimise transmission prices and current platform suppliers resort to them with various levels of effectiveness.

Quote conflation and removing algorithms sift by way of the tick-by-tick information, smoothing it by not transmitting duplicate ticks and eradicating quotes which can be not legitimate, as well as taking bandwidth into consideration. In different phrases, if the incoming stream reads as follows: “aabbbabc,” after quote conflation it is going to look extra like: “ababc.” The info forwarded on to shoppers seems similar to the actual world market information with duplicates and redundant quotes having been eliminated. This will unencumber a lot wanted bandwidth and scale back latency, particularly throughout instances of excessive volatility.

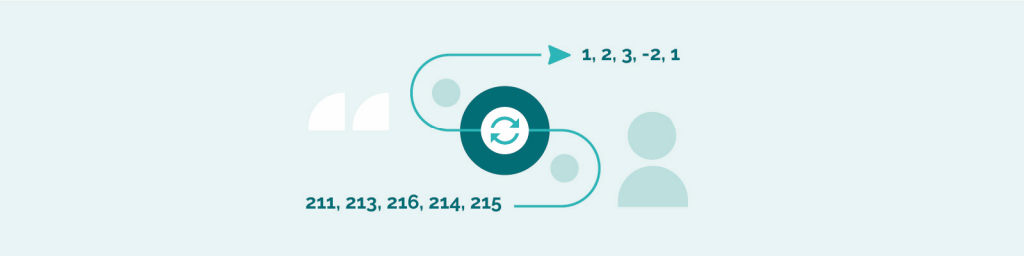

Delta-encoding is one other technique by which streams of information may be transmitted and saved within the type of variations (or deltas) between sequential values, fairly than sending your complete stream of values as is, full with their redundancies. Delta-encoding reduces the variance of the values to be transmitted and saved. So, as a substitute of a stream of worth ticks that seem as follows: “211, 213, 216, 214, 215”, after delta-encoding they might appear like this: 1, 2, 3, -2, 1. By solely transmitting the variations, delta-encoding reduces the variety of bits required to ship and retailer historic market information.

For incumbents within the area, optimisations on this space are solely going to be related in case you’re within the means of rethinking your current platform technique, or if in case you have already partnered with a supplier who locations a premium of customisability and is prepared to work with you to attain the efficiencies that your online business requires. Newcomers to the area have a wider set of choices obtainable to them than the brokers of even a decade in the past. They should rigorously stability the price and time necessities of growing a proprietary platform from scratch, or to associate with a 3rd occasion that has the expertise and willingness to tailor its current product line to their wants.

Remaining Ideas